Effective Strategies for Risk Management PrimeXBT Forex Trading

In the dynamic world of Forex trading, mastering the art of risk management is essential for retail and professional traders alike. Many traders enter the market with the hope of making quick profits, yet the reality is that success in Forex trading requires more than just understanding currency movements. A well-structured risk management strategy is vital to safeguard your investment and ensure long-term financial growth. This article will delve into effective risk management strategies specific to Risk Management PrimeXBT Forex Trading https://primexbtforex.com/risk-management/, providing you with practical advice to navigate the complexities of the market while minimizing risks.

Understanding Risk Management in Forex Trading

Risk management in Forex trading refers to the process of identifying, assessing, and controlling potential financial losses that can arise from trading activities. Unlike other investment environments, Forex trading is highly volatile, which can result in significant price fluctuations. Therefore, establishing a solid risk management framework is essential for traders to protect their capital.

Key Components of an Effective Risk Management Strategy

To create an effective risk management strategy, traders must consider several key components:

- Risk-Reward Ratio: This ratio measures the potential profit of a trade against the potential loss. A common rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning for every dollar risked, the potential profit should be two dollars.

- Position Sizing: Position sizing determines how much capital to allocate for each trade based on the trader's risk tolerance. A general rule is to risk no more than 2% of your trading capital on any single trade.

- Stop-Loss Orders: Utilizing stop-loss orders helps traders limit potential losses by automatically closing a trade when the price reaches a certain level. This is crucial for preventing emotional decision-making during trading.

- Diversification: Diversifying your trading portfolio by investing in a variety of currency pairs can help spread risk. This minimizes the potential impact of a single trade on your overall capital.

- Regular Assessment: Continuously assessing and adjusting your risk management strategy is critical as market conditions change. Regular reviews of your trading plan can help identify weaknesses and areas for improvement.

Implementing a Trading Plan

- Trading Goals: Define both short-term and long-term goals that are specific, measurable, achievable, relevant, and time-bound (SMART).

- Market Analysis: Specify the analytical methods you will use to determine entry and exit points, whether through fundamental analysis, technical analysis, or a combination of both.

- Risk Tolerance: Acknowledge your risk tolerance and set parameters that align with your investment psychology.

- Record Keeping: Maintain a trading journal to document all trades, including successes and failures. This will help you learn from your experiences and refine your strategy over time.

Psychological Aspects of Risk Management

Emotional discipline is one of the most critical aspects of risk management in Forex trading. Many traders find that emotions such as fear and greed can cloud their judgment, leading to poor decision-making. Here are some tips to maintain psychological discipline:

- Stick to Your Plan: Regardless of market fluctuations, remain disciplined in following your trading plan to avoid impulsive trading decisions.

- Avoid Overtrading: Trading too frequently or on impulsive signals can lead to unnecessary losses. Be selective about trades and only act when the plan indicates clear opportunities.

- Set Realistic Expectations: Understand that losses are part of trading. Setting realistic profit expectations will help maintain a balanced perspective during trading.

- Practice Mindfulness: Techniques such as deep breathing, meditation, or taking breaks can help clear your mind and maintain focus while trading.

Using Technology for Effective Risk Management

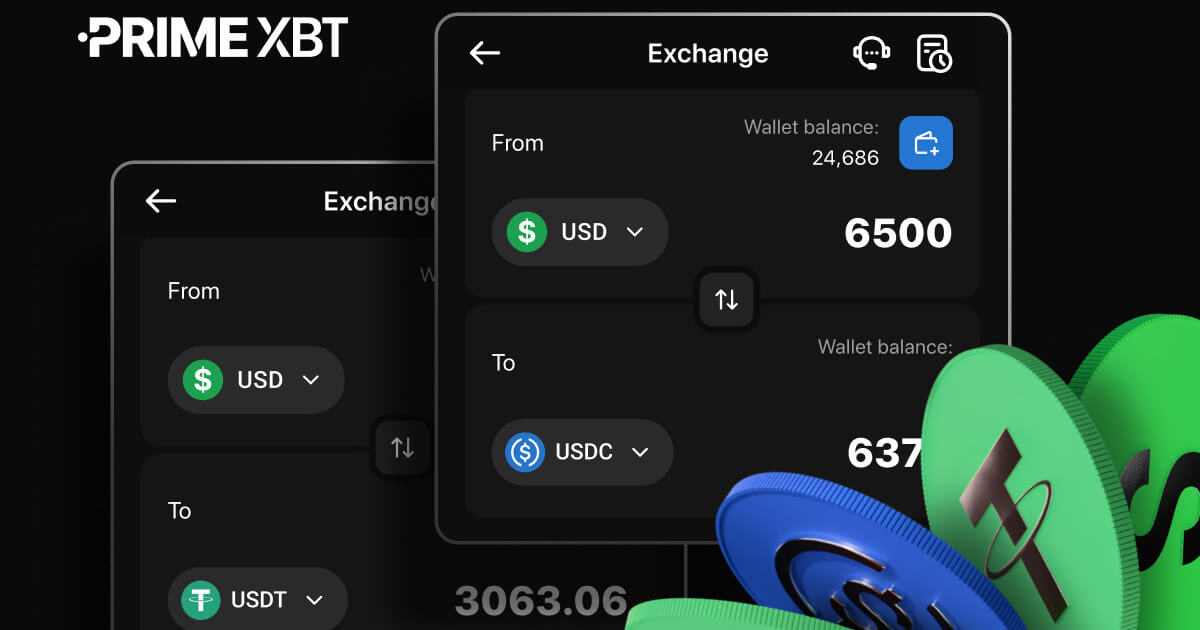

The advent of technology has revolutionized the Forex trading landscape. Various tools and platforms now facilitate risk management, and one such platform is PrimeXBT. PrimeXBT offers innovative features that help traders establish a robust risk management framework:

- Advanced Charting Tools: PrimeXBT provides access to advanced charting tools that allow for comprehensive market analysis, enabling traders to make informed decisions.

- Customizable Alerts: Traders can set up customizable alerts for specific price points or market conditions to stay informed without being glued to their screens.

- Performance Metrics: Track your trading performance through detailed metrics available on the platform, allowing you to identify strengths and weaknesses in your trading strategy.

- Risk Management Features: Leverage features such as stop-loss orders, take-profit orders, and margin settings to help limit your risk exposure.

Conclusion

In conclusion, effective risk management is a cornerstone of successful Forex trading on platforms like PrimeXBT. By understanding the components of a solid risk management strategy, implementing a comprehensive trading plan, maintaining psychological discipline, and leveraging technological advancements, traders can significantly enhance their chances of achieving long-term success. Remember, Forex trading is not just about making profits; it’s about managing risks effectively to safeguard your capital while navigating the ever-changing market landscape. By prioritizing risk management, you can create a sustainable trading journey that leads to both financial security and personal satisfaction.